In the realm of business, navigating through the complexities of Goods and Services Tax (GST) is crucial for compliance and operational efficiency. When it comes to GST registration, understanding the nuances of essential documents is paramount. Among these, the rent agreement holds a pivotal role.

This article aims to shed light on the indispensable pointers within a rent agreement that businesses must consider to facilitate a smooth and seamless GST registration process.

By delving into the intricacies of this document, businesses can ensure compliance with GST regulations and avoid potential pitfalls, fostering a foundation for successful and hassle-free operations within the GST framework.

Goods and Services Tax (GST) is a crucial indirect tax reform that has transformed the Indian Taxation System’s scenario. Businesses that are involved in taxable supplies with a yearly turnover beyond the mentioned limit are required to register for GST. One of the indispensable documents required during GST registration is an authentic rent agreement.

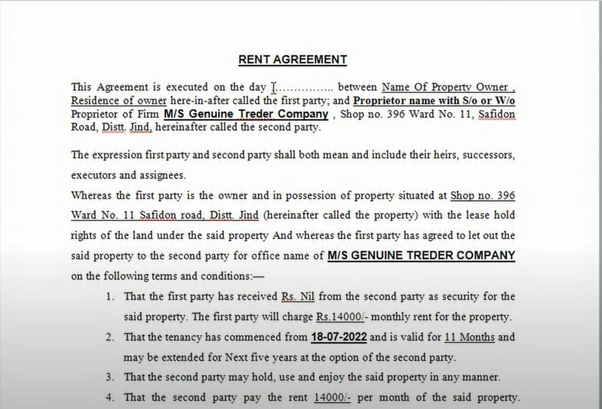

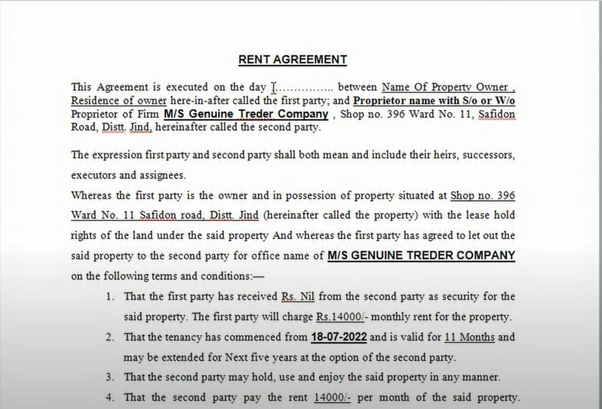

A rent agreement GST implications is a legal document that states the terms and conditions between a landlord and tenant. The businesses that are operated from rental properties must have a valid rental agreement while applying for GST registration on the rent agreement.

Struggling with Billing and Inventory? Join thousands of Indian MSMEs who use CaptainBiz for a hassle-free billing solution.

A rent agreement GST implications must have certain elements that are compulsory to be included. The key components of a perfectly drafted rent agreement are as follows:

In the pre-GST period, the landlord obtained a service tax registration if their total taxable services, including the rental income from all properties, exceeded Rs.10 lakh per year. The landlord would not be attracted to service tax as long as the rental income from all the properties that have been rented out does not exceed Rs.10 lakh per year.

As per the previous tax regime, commercial properties alone that were let out would attract service tax. This was applied even if a residential property was used for commercial purposes. Service tax was levied at 15% of the rent, for commercial properties. Additionally, the rental income from residential properties did not attract service tax.

According to the GST Act, renting out an immobile property would be considered as a supply of services. GST, however, will be applied only to specific types of rent:

This type of renting is considered a supply of services and thus attracts tax. When you rent out a residential property for residential purposes, it is exempted from GST. Any other type of lease or renting out of the immovable property for doing business would attract GST at 18%, as it would be treated as a supply of service.

In the 48th GST Council meeting, the Council clarified that no GST is payable where a residential dwelling is rented to a registered person if the same is rented in their personal capacity and for use as their own residence, which means that where a registered person is a proprietor of a firm and they have rented out a residential property in their personal capacity and the property is for use as their own residence, then no GST will be applicable.

The documents required for GST Registration for Rental properties are as follows:

| Pan Card of the Business Company |

| Proof of Business Registration |

| Photographs of all the Directors and Signatories |

| Bank Account Details |

| Address of Business Location |

In order to confirm the legality and validity of the rent agreement for GST registration, businesses must consider the following:

A valid rent agreement plays a major role during the registration process as it provides proof of business premises. Businesses should confirm that their rent agreements are framed correctly, have fulfilled all legal requirements and comprise all essential components. Hence, obtaining GST registration is crucial for businesses to function efficiently and legally.

Yes, a valid rent agreement is compulsory for GST registration when the business is operating from rented premises.

Sometimes in some cases, a sub-lease agreement might be acceptable, but it is suggested to consult a legal expert to ensure compliance with GST regulations.

The rent agreement must be in the name of the business entity seeking GST registration and not in the name of individual partners or directors.

Yes, a single rent agreement can be used to register more than one business location, as a condition if they are covered under the same agreement.

It is not compulsory to notarize the rental agreement unless there is any specific need from the registration authorities. Mostly, rental agreements printed on stamp paper serve the purpose.

In order to start the GST registration process for a proprietorship, essential documents include PAN and Aadhaar details, business registration proofs, and address validations. These documents form the core requirements of a successful GST registration for proprietorships.

After submission of the GST registration application for a proprietorship, you can track the status using the Application Reference Number (ARN) generated during the process.

In the Rent Agreement, it’s compulsory to include details like the names of both the party tenant and landlord, the address of the society, the tenure of the agreement, the Rent amount, and any terms and conditions agreed upon. It’s also suggested to include the clauses related to maintenance responsibilities, termination conditions, and any other related terms.

There is no limit to the Rent Agreement for GST Registration since the Goods and Services Tax regulations in India do not have any specifications. Yet there are certain conditions applied for the registration of GST on commercial property. That is if there are cases of inter-state supply then the GST registration is compulsory.

No, commercial rent is not exempted from GST. Under the GST Act, leasing or renting of commercial property, comprising shops, offices, or warehouses, falls under the category of supply of services and is applicable for GST @18%.

Kiran Chaudhary, a seasoned freelance writer with over 4 years of expertise, specializes in crafting clear and engaging technical and financial articles. Her passion for simplifying complex concepts shines through in her work, making intricate subjects accessible to a diverse audience. Kiran's dedication to delivering high-quality content has earned her a reputation as a reliable and knowledgeable writer in the industry. When not on the keyboard, she enjoys exploring new topics and sharing her expertise to empower readers with valuable insights.